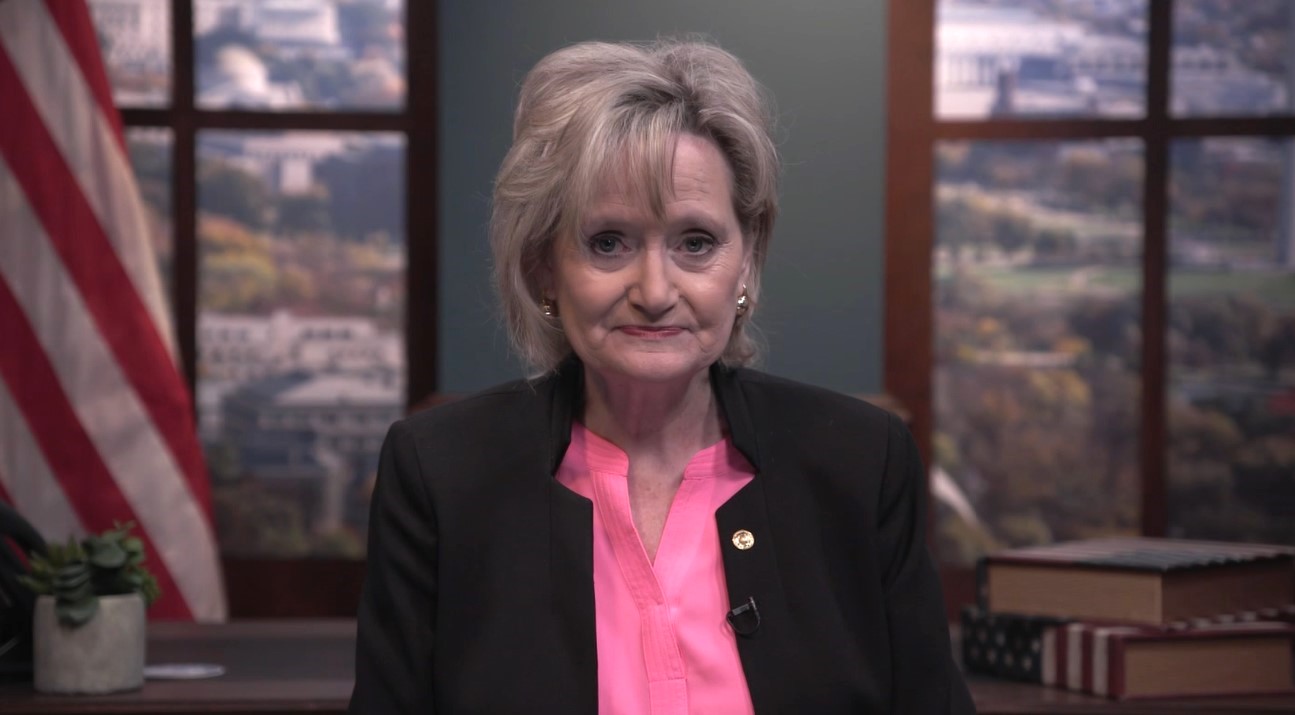

HYDE-SMITH STRESSES IMPORTANCE OF EXTENDING TRUMP TAX CUTS IN VIDEO STATEMENT

Passage of Budget Resolution in Senate & House Unlocks Process to Ensure Tax Relief for American Families, Small Businesses

VIDEO: Senator Hyde-Smith Stresses the Importance of Extending President Trump’s Expiring 2017 Tax Cuts.

WASHINGTON, D.C. – U.S. Senator Cindy Hyde-Smith (R-Miss.), a member of the Senate Appropriations Committee, today released a video statement stressing the need for Congress to extend expiring provisions of the 2017 Tax Cuts and Jobs Act, which left undone would increase taxes for families and workers in all income brackets beginning in 2026.

Hyde-Smith issued the statement following Thursday’s U.S. House of Representatives approval of a FY2025 Budget Resolution, following Senate approval of the measure last Saturday. These legislative actions unlock the reconciliation process, which will allow Republicans to procedurally fast-track consideration of President Trump’s policy priorities, including extending tax cuts that will expire in December.

“We’ve seen firsthand how the Tax Cuts and Jobs Act has benefited Mississippians. Families have kept more of their hard-earned money. Small businesses have expanded and hired more workers. Farmers have invested in new equipment and technology to stay competitive,” Hyde-Smith said. “Failing to act would mean a $4.5-trillion-dollar tax increase on American families and businesses at the end of the year. Everyone will pay.”

“The other side loves to claim that the Tax Cuts and Jobs Act only benefits the ultra-wealthy. But let me be clear—most Mississippians aren’t billionaires. They’re hardworking people running small businesses, raising families, working hard every single day to make ends meet. For them, the extended Child Tax Credit has helped with basics like food and school supplies. The 20 percent pass-through deduction has helped keep family-owned shops and farms afloat.” Hyde-Smith continued. “Next time you hear these tax cuts labeled as ‘for the rich,’ think about your neighbor who runs a small business or your friends with children. How would they fare if Congress doesn’t act?”

The Senate- and House-passed budget resolutions will serve as a blueprint for congressional committees in coming weeks to work on recommended spending, revenue targets, and deficit reduction goals over the next 10 years. The outcome is intended to advance President Trump’s and Republican’s agenda to cut taxes, secure the border, strengthen the military, and increase U.S. energy production.

###